The Bishop Neumann Legacy Society is a group of individuals who have chosen to support Bishop Neumann High School’s mission and long-term sustainability by including the school or its endowment in their estate plans or through planned giving. As members of the Legacy Society, these individuals leave a lasting impact on the school and its community, ensuring that their generosity and commitment endure beyond their lifetime. Membership in the Legacy Society comes with special recognition and benefits, providing opportunities for engagement, exclusive events, and acknowledgment for their extraordinary support. By joining the Legacy Society, individuals align their philanthropic vision with their estate planning, leaving a significant legacy that will benefit future generations of students and contribute to the continued success of Bishop Neumann High School.

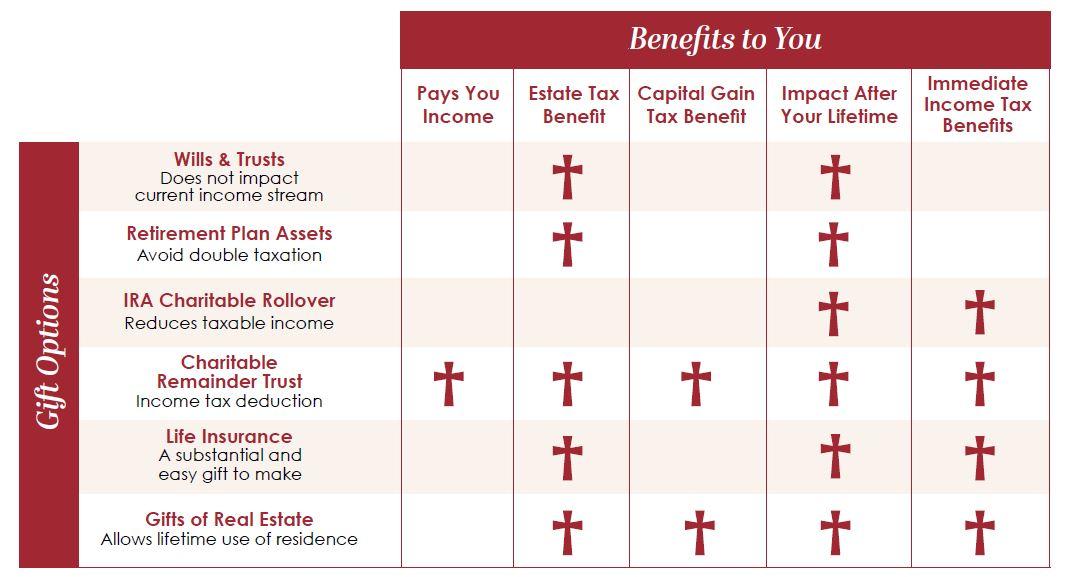

Planned gifts are sensible and effective ways to help maximize both your tax benefit and your giving dollars. Giving to

Bishop Neumann ensures the continuation of Catholic education in Saunders County. Our current Director, Ryan Mascarello, is a licensed financial advisor and would love to consult with you on how your planned giving would help leave a legacy for years to come in the Catholic community of Saunders County.

These are the Legacy Society members that we are currently aware of in the Bishop Neumann community that have included us in their estate plans. Thank you!

Glenn and Lynn Baumert

Cherovsky Family

Dan ’72 and Kelly (Reeves) ’79 Dailey

Gregg ’79 and Eva Fujan

Jim and Marlene Fujan

Fr. Charles Townsend

Creating Your Legacy

- Make a difference by investing in Catholic education

- Feel a sense of fulfillment by being a Steward of God

- Enjoy the legacy YOU created

- nearly 50% of adults DO NOT have a current will

- nearly 60% of adults DO NOT have enough life insurance

- Receive tax advantages through charitable giving

- Receive recognition today for your future gift

- Your name will be presented on a beautiful plaque in the school’s hallway with other Legacy Society members

Ways to Give

Cash – Your gift by cash/check/credit card is an investment in our school and our Ministry of Catholic Education.

Stock, bonds, mutual funds – Stocks and securities provide an immediate gift to Bishop Neumann and are a wonderful way to give, especially if they have appreciated in value. You receive two

tax benefits, an income tax deduction for the fair market value of the stock (not just the original investment) and avoidance of any capital gains tax on the stock’s appreciated values. Donating stock removes it from your estate, saving you possible estate taxes.

Will Bequests – You can name Bishop Neumann as a beneficiary in your will by leaving a gift of a percentage of your estate, a specific amount or a residuary amount.

Gift Annuities – You can make an irrevocable gift to Bishop Neumann and it provides income to you for life.

- Gift annuity rates range from between 5 and 9 percent, depending on your age.

- If you have stock or another appreciated asset you can contribute it to a gift annuity and avoid capital gains.

- You receive annual payments.

- You fund it with cash, securities, tangible property or real estate.

- Your annual income depends on your age.

- You receive an income tax deduction for a portion of the value of your gift the year you make it.

- If you desire to make a gift but need stable annual income, a gift annuity is an option.

- The asset you use to fund your gift annuity is removed from your estate, saving you possible estate taxes

Life Income Agreements (trusts, charitable gift annuities) -You can make an irrevocable gift and receive income payments similar to a gift annuity. The difference is that a charitable trust is a larger gift ($100,000 or more) and offers you more options.

- You can receive quarterly, semi-annual or annual payments.

- You name a professional trustee to manage the trust or you can name yourself as trustee.

- You can create a trust that allows you to make additional payments when you desire or have the financial need.

- You can create the trust to last for a period of years.

- You receive an income tax deduction for a portion of the value you make the gift in the year you make it.

- The asset you use to fund the trust is removed from your estate, saving you possible estate taxes.

Beneficiary of Retirement Accounts – By donating an IRA or 401K you avoid anyone of your beneficiaries having to pay income tax. Your deferred retirement accounts are not immune to income tax. Someone will have to pay those taxes, except for non-profits. What’s more, if you’ve reached the age where you need to take required minimum distributions (RMDs) from your traditional IRAs, you can avoid paying taxes on the money by donating it to us.

Beneficiary of Life Insurance – You can donate either a paid-up policy or start a new policy. In both cases, designate Bishop Neumann as the owner and beneficiary of the policy, or the school can be named as a secondary beneficiary, after your spouse or your children. A paid-up policy gives you a tax deduction equal to the cash value of the policy. Donating a new policy allows you to deduct the full value of the annual premiums you pay. When you make Bishop Neumann the owner and beneficiary of the policy, it removes the life insurance from your estate, saving you possible estate taxes.

Real Estate – Donating real estate gives you an income tax deduction for the fair market value of your property.

- If you own your home, you can create a life estate. You’ll live in your home and enjoy full use of it while you are alive. Upon your death, Bishop Neumann assumes ownership of your property. You can claim a tax deduction in the year you create the life estate.

- If you own a piece of property that currently provides little to no income for you, create a charitable trust with the real estate as the primary asset. You avoid any capital gains on the real estate when it is eventually sold. You receive a tax deduction in the year you make the gift. You turn a former, low-income-producing asset into an asset that provides you with sufficient income.

- Donating real estate removes the asset from your estate, saving you possible estate taxes

Bishop-Neumann-Legacy-Society-Pledge-Form

PLEASE NOTIFY US THAT WE ARE A PART OF YOUR LEGACY FOR OUR RECORDS AND ALSO SO WE CAN HONOR YOU TODAY!

Legal Name: Bishop Neumann Central High School

Tax ID #47-0486467

Address: 202 South Linden St, Wahoo, NE 68066

Legal Name: Bishop Neumann Central High School Endowment

Tax ID #47-0632908

Address: 202 South Linden St, Wahoo, NE 68066